可信數據有限公司

數據入庫, 增資降債

數據資產已成為推動企業增長和創新的關鍵要素

數據資產的崛起

驅動企業轉型與未來發展

深入探索數據資產

數據資產的潛力無可限量,能夠改變企業的運作模式和決策過程,為企業創造新的價值和增長機會。

May 15, 2025May 12, 2025May 10, 2025May 8, 2025May 6, 2025May 4, 2025更多文章數據資產的實際案例

探索數據資產在各行各業中的應用,發現其帶來的變革性影響。

零售業的數據應用

許多零售企業利用數據分析技術,優化庫存管理和提升顧客體驗,從而實現了銷售額的顯著增長。此外,透過精準的市場分析,企業能夠更好地制定促銷策略,進一步增強顧客的忠誠度。這些措施不僅提升了顧客的購物體驗,還有效降低了運營成本,讓企業在競爭激烈的市場中脫穎而出。隨著數據技術的進一步發展,未來零售企業還將能夠實現更高層次的個性化服務,進一步滿足消費者多樣化的需求,創造更加靈活的商業模式,並提升整體市場競爭力。

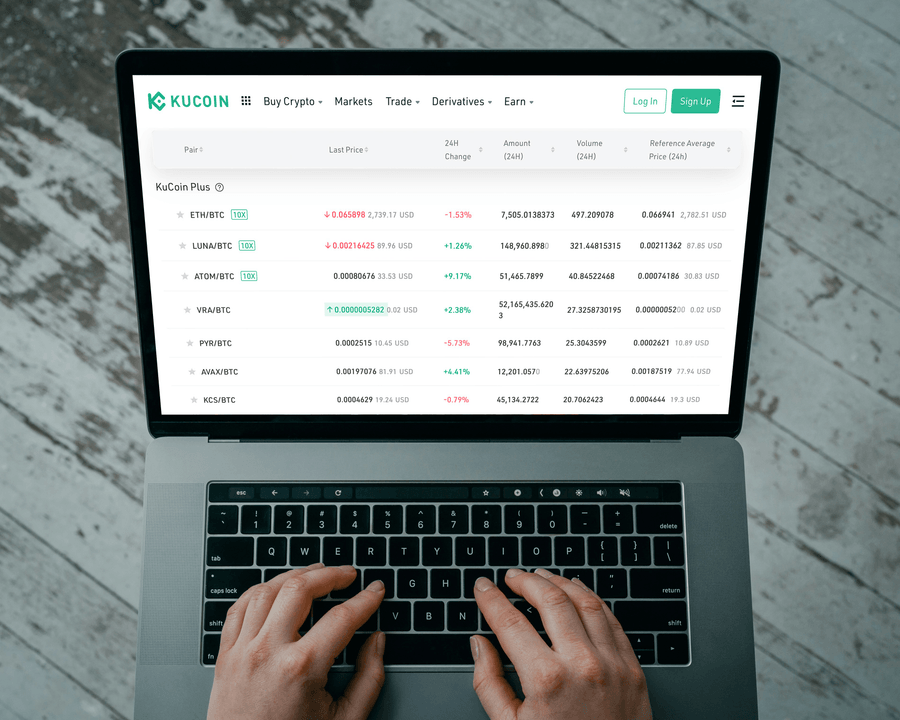

金融服務的數據驅動

金融機構利用數據資產進行風險管理和信用評估,通過大數據模型準確預測市場變化,提高業務決策的準確性。這不僅增強了客戶信任,也促進了資本流動的效率,有助於行業的穩定發展。隨著技術的進步,金融機構還能夠實現更加智能化的服務,進一步提升客戶體驗和市場競爭力。未來,數據資產將成為金融創新的核心,幫助機構開發個性化產品,滿足多元化的客戶需求,並在激烈的市場競爭中保持優勢。

醫療健康的數據應用,幫助醫療專業人員做出更好的診斷。

在醫療行業中,數據資產的應用能夠促進疾病預測和個性化醫療,改善患者的治療效果和健康管理。此外,透過數據分析,醫療機構能夠更有效地配置資源,提升整體服務質量,從而增強患者的滿意度。這些數據驅動的創新不僅提升了診療效率,還能為醫療政策制定提供有力支持,使得整個行業更具前瞻性和應變能力。隨著人工智慧技術的進一步發展,醫療機構將能夠實現更高效的數據整合,從而提供更為精準的醫療服務,並在疾病預防和健康管理中發揮更大的作用,進一步推動行業的整體革新。

擬入表資料資產的法律盡職調查要點

2022年12月,中共中央、國務院發布了《關於建構資料基礎制度更好發揮資料要素作用的意見》(以下簡稱「《資料二十條》」),創意提出建立資料資源持有權、資料加工使用權、資料產品經營權等分置的產權運作機制,為後續資料產權制度的建構奠定了基礎。

具有以下共通性條件:

1.相關數據資源由企業合法擁有或控制

2.預期會為企業帶來經濟利益

3.相關資料資源的成本或價值能夠可靠地計量數據資產的主要優勢,助力企業在競爭中脫穎而出。

數據資產的價值不僅限於增長,更在於提升整體業務效率和創新能力。

數據入庫, 增資降債

透過對數據的深入分析,企業能夠做出更具根據的決策,從而數據入庫, 增資降債。這不僅提升了企業的財務穩定性,同時還為未來的發展奠定了堅實的基礎。有效的數據管理還能促進資源的最佳配置,提升運營效率,讓企業在瞬息萬變的市場中始終保持競爭優勢。

促進創新與增長

數據資產能夠啟發新的業務模式和產品創新,企業通過分析市場趨勢和消費者行為,能夠及時調整策略,抓住增長機遇。這不僅促進了業務擴展,也增強了市場競爭力。隨著數據分析技術的進步,企業能夠更快速地適應環境變化,並在不斷演進的市場中保持優勢,從而實現可持續的增長。

提升客戶體驗

企業通過數據資產獲得的深入洞見,可以更好地理解客戶需求,提供個性化的產品和服務。這不僅能提升客戶滿意度,還能增強客戶的忠誠度,最終實現長期的商業成功。透過持續的數據分析,企業能夠不斷調整其策略,從而適應市場的變化,進一步增強與客戶之間的互動,提升品牌形象和市場影響力。